Business analytics are a valuable tool for organizations of any size. Many small businesses may think data analytics are too expensive or out of reach, and while that may have been true a few years ago, it is no longer the case. In fact, you are likely already using some analytics. Let’s dig in a bit, starting with the basics.

What are business analytics?

Business analytics are methods and models used to analyze data and gain insights. The purpose is to gather data, often from various sources and answer questions about what happened, why it happened and what is going to happen in the future. Analytics are especially powerful in communicating results to a broad audience using visuals, infographics and data storytelling.

Types of business analytics

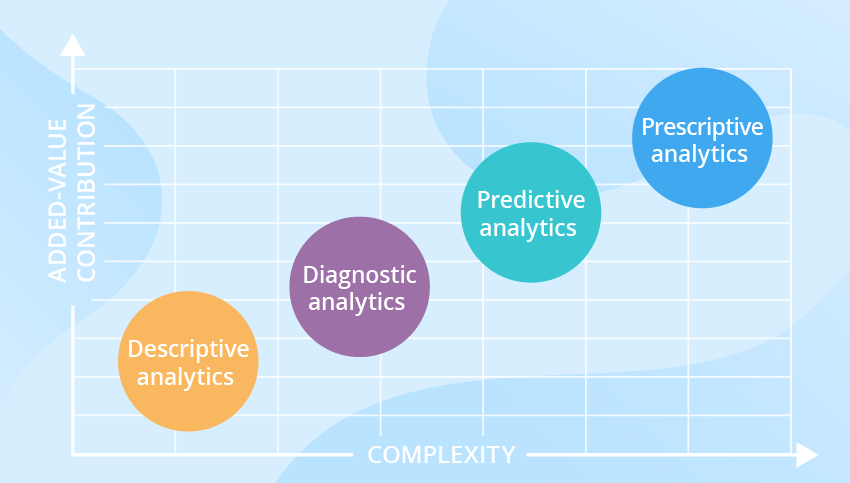

There are four main pillars of analytics described below that are complimentary, and often done as building blocks or related steps. While there may be exceptions, in general each pillar builds on the one before it and is used in completing the one that follows it. The level of complexity generally increases as well as with each pillar.

Descriptive Analytics

This is the foundation of data analytics and often the first step of a multi-stage process. Descriptive analytics use historical information to answer the question “what happened”? The chart above is an example of descriptive analytics. Profit and Loss Statements, Sales Reports and Inventory Turnover all result from descriptive analytics. Creating or using reports like these are common examples of being engaged in analytics without realizing it.

Diagnostic Analytics

Diagnostic analytics uses information from descriptive analytics and tries to answer the question “why did this happen?” Tools like pivot tables and drill down filters can help with data mining and correlations with a deep dive into the data. Diagnostics may bring in outside data sources as well to paint a larger picture. If a business is trying to figure out why retail foot traffic was down in January compared to prior years, they might look at weather events to see if there was a big snow storm or unusually cold weather that would have kept people from venturing out.

Predictive Analytics

Predictive analytics takes the what and the why from the previous pillars to forecast future outcomes by answering the question “what is going to happen?” These can be fairly straightforward by using historical information assumptions about how the main drivers will change in the future, or incredibly complex by using machine learning, regression analysis and modeling. Some common examples used in business are cash flow forecasts and year-end revenue and expense forecasts.

Prescriptive Analytics

As the final and most difficult to achieve pillar, prescriptive analytics pulls in the previous pillars to answer the question “what should we do?” The result of prescriptive analysis offers recommendations to achieve future goals and may involve data simulations and optimization techniques. While not all businesses need to do this full in depth analysis, it is helpful to think about the questions posed and incorporate data driven decision making into core processes.

How to get started with business analytics

You very likely already have gotten started! If you are preparing or using profit and loss reports, cash flow statements or sales reports then you are using business analytics. A great next step is to think about how business analytics can help with communication to managers, owners, employees and customers. Adding visual charts to reports can help anyone easily understand and interpret results.

Data automation is a valuable tool as well. If you are manually compiling data from sources and creating your own reports, see if your software allows you to build a custom report or has some standard reports you may not be aware of. If that is not an option, Excel can be a great tool as well by using separate tabs for data along with formulas built into report tabs. Just be sure your formulas are looking at the full range of data – this is one of the most common errors I see.

As you work on improving your descriptive analytics, begin incorporating diagnostic analytics. Again, you are very likely already doing this to some extent whether or not you think of it that way. Comparing prior periods to current period results is incredibly helpful to give context to your data. Look for any outliers first, or any amounts that are vastly different from prior periods. Pulling data into a pivot table is a great place to start with a deep dive into seeing what happened. This can help you quickly find errors and understand what has changed over time.

From there, you can start to do future planning with forecasts. Some accounting software like QuickBooks have cash flow forecasting built in at certain subscription levels. To learn more about customized analytics along with budgeting and forecasting tools, reach out to Spencer Accounting and we would be happy to create a package that meets your needs.

Organized Record Keeping

Keep all receipts, invoices and bank statements together in one place. This doesn’t need to be a formal system or filing cabinet, but having documents accessible will make things easier if you need to refer back to them. Its best to organize by type or by month to help with accessing. Many of these documents are available electronically which further streamlines the process.

Separate Personal and Business Expenses

Open a separate bank account and credit card accounts for your business, or if you are a sole proprietor have a credit card that is only used for business expenses. This simplifies the tracking process and ensures tax compliance. It will also save your tax professional a lot of time – likely saving you money on costly hourly fees.

Track Income and Expenses

This should be done at least monthly, but depending on the nature of your business and volume of transactions weekly tracking may be more appropriate. It’s important to categorize expenses correctly for business operating and tax purposes. Some items that seem like expenses may be depreciable assets. Meal expenses are deductible at either 50% or 100% depending on the circumstances. Client entertainment is not deductible at all, but taking a client to a business lunch is 50% deductible. These are just a few examples of why it is important to categorize expenses correctly.

Create a Budget

Planning for revenue and expenses will help you more effectively manage your cash flow, labor needs and growth plans. Budgeting can be intimidating, but taking one small step at a time will help you get started. Start by listing all of your recurring monthly expenses like rent, utilities, cell phone, payroll, etc. Then list your expected revenue each month, by looking at prior years and upcoming projects and expected sales. If you’re not sure, track your revenue for a few months, and then apply the average to your budget. Continue looking at the budget vs. actual each month to improve your estimates. That’s it – you have started budgeting!

Tax Planning

Be sure to set aside a portion of revenue for taxes each month, so you have funds to make your quarterly estimated payments. If you are using a payroll service, make sure you have a process in place and funds to cover payroll taxes and required filings. Get up to date on your state’s sales tax payments and filings, the same goes for your local or county tax office. Even if your business does not own real estate or vehicles, you may still be required to pay taxes on business assets like computers, equipment and furniture.

Analyze Financial Reports

Understanding your financial reports will help you better understand the operations and financial results for your business. They can help drive insights and lead to data-driven decision making. The Profit and Loss Statement summarizes revenue and expenses for a given period of time. This is generally monthly, quarterly and annually. This can help you analyze whether specific products are services are profitable, and becoming more or less profitable over time. You can compare the P&L to results from prior periods to see if your business is meeting your goals over time. The Balance Sheet offers a snapshot of the business value at a point in time. It gives insight into the health of the business by showing assets, liabilities and owner’s equity. The Balance Sheet can also be compared to prior periods to see if the business is adding or losing value. The other key statement is the Cash Flow Statement. It shows how much cash the business is generated, and the ability to meet payroll and other expense obligations.

Use Financial Software

Financial software can be surprisingly affordable, depending on the size and needs of the business. It allows for automation of tasks like invoicing and expense tracking which will save valuable time. You can also connect your bank and credit card to import your transactions. This ensures an accurate and complete picture of your financial transactions. If you are using a spreadsheet or other manual process, it can be easy to forget to record an expense, or accidentally enter the wrong amount. The automations in financial software help prevent that.

Invest in Training or Professional Services

If you handle your own bookkeeping, it is well worth investing in training to understand the basics and for the software. Most software providers offer affordable training in their products and many accounting companies offer that as a service. This will help you ensure you are using the software correctly, can troubleshoot errors and get accurate results. If you don’t want to handle this yourself, or have the time for it, there are companies that offer these services. Some will charge by the hour, and others will charge a set monthly fee. Managing it yourself is fine, just make sure you have the dedicated time for it. Otherwise, it may be best to hire an employee or seek a professional services company that can take care of it for you.

Proper bookkeeping is important for small businesses to track finances accurately and make informed decisions. Small businesses may not see the need to spend a lot of time or effort on it, but it can be the difference maker in helping business owners achieve their goals and understand the business.

Organized Record Keeping

Keep all receipts, invoices and bank statements together in one place. This doesn’t need to be a formal system or filing cabinet, but having documents accessible will make things easier if you need to refer back to them. Its best to organize by type or by month to help with accessing. Many of these documents are available electronically which further streamlines the process.

Separate Personal and Business Expenses

Open a separate bank account and credit card accounts for your business, or if you are a sole proprietor have a credit card that is only used for business expenses. This simplifies the tracking process and ensures tax compliance. It will also save your tax professional a lot of time – likely saving you money on costly hourly fees.

Track Income and Expenses

This should be done at least monthly, but depending on the nature of your business and volume of transactions weekly tracking may be more appropriate. It’s important to categorize expenses correctly for business operating and tax purposes. Some items that seem like expenses may be depreciable assets. Meal expenses are deductible at either 50% or 100% depending on the circumstances. Client entertainment is not deductible at all, but taking a client to a business lunch is 50% deductible. These are just a few examples of why it is important to categorize expenses correctly.

Create a Budget

Planning for revenue and expenses will help you more effectively manage your cash flow, labor needs and growth plans. Budgeting can be intimidating, but taking one small step at a time will help you get started. Start by listing all of your recurring monthly expenses like rent, utilities, cell phone, payroll, etc. Then list your expected revenue each month, by looking at prior years and upcoming projects and expected sales. If you’re not sure, track your revenue for a few months, and then apply the average to your budget. Continue looking at the budget vs. actual each month to improve your estimates. That’s it – you have started budgeting!

Tax Planning

Be sure to set aside a portion of revenue for taxes each month, so you have funds to make your quarterly estimated payments. If you are using a payroll service, make sure you have a process in place and funds to cover payroll taxes and required filings. Get up to date on your state’s sales tax payments and filings, the same goes for your local or county tax office. Even if your business does not own real estate or vehicles, you may still be required to pay taxes on business assets like computers, equipment and furniture.

Analyze Financial Reports

Understanding your financial reports will help you better understand the operations and financial results for your business. They can help drive insights and lead to data-driven decision making. The Profit and Loss Statement summarizes revenue and expenses for a given period of time. This is generally monthly, quarterly and annually. This can help you analyze whether specific products are services are profitable, and becoming more or less profitable over time. You can compare the P&L to results from prior periods to see if your business is meeting your goals over time. The Balance Sheet offers a snapshot of the business value at a point in time. It gives insight into the health of the business by showing assets, liabilities and owner’s equity. The Balance Sheet can also be compared to prior periods to see if the business is adding or losing value. The other key statement is the Cash Flow Statement. It shows how much cash the business is generated, and the ability to meet payroll and other expense obligations.

Use Financial Software

Financial software can be surprisingly affordable, depending on the size and needs of the business. It allows for automation of tasks like invoicing and expense tracking which will save valuable time. You can also connect your bank and credit card to import your transactions. This ensures an accurate and complete picture of your financial transactions. If you are using a spreadsheet or other manual process, it can be easy to forget to record an expense, or accidentally enter the wrong amount. The automations in financial software help prevent that.

Invest in Training or Professional Services

If you handle your own bookkeeping, it is well worth investing in training to understand the basics and for the software. Most software providers offer affordable training in their products and many accounting companies offer that as a service. This will help you ensure you are using the software correctly, can troubleshoot errors and get accurate results. If you don’t want to handle this yourself, or have the time for it, there are companies that offer these services. Some will charge by the hour, and others will charge a set monthly fee. Managing it yourself is fine, just make sure you have the dedicated time for it. Otherwise, it may be best to hire an employee or seek a professional services company that can take care of it for you.